Welcome to the latest edition of JBR Capital’s Luxury Car Report, an in-depth review of the trends shaping today’s luxury pre-owned automotive landscape.

Drawing on proprietary lending data, the report provides exclusive insight into the dynamics of the UK luxury and supercar market, combining real-world data with expert analysis to help readers navigate an ever evolving sector.

In JBR’s context, a High-End Luxury Vehicle (HEV) is defined as a vehicle positioned within the upper segment of the automotive market, typically valued above £50,000, and recognised for delivering superior levels of comfort, quality, equipment, and refinement.

Covering the period from January 2021 to September 2025, the report tracks key developments in used vehicle values, buyer demographics, and market composition.

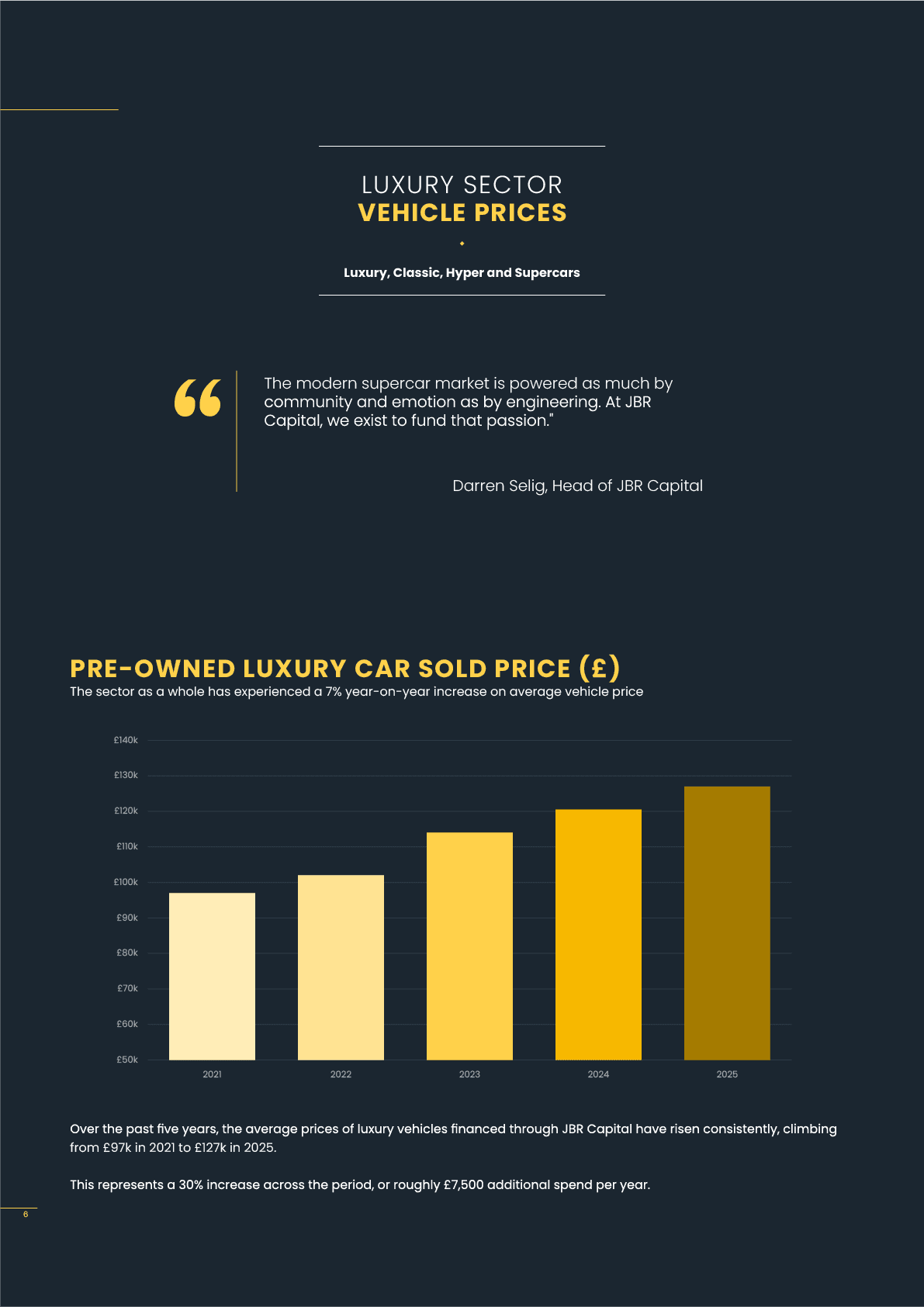

Over the past four years, luxury car prices have risen steadily, up 30% since 2021 (p.g. 6), driven by inflation and showing record resilience in the face of economic headwinds. Our analysis explores how new models, consumer preferences, and shifting power-train choices, from electric back to petrol are driving both value and demand across segments.

Supercars and luxury SUVs continue to be by far the most popular choices for JBR Capital clients. Between 2023 and 2025, the number of Supercars and SUVs financed by clients rose to account for 65% of the market share across the pre-owned luxury sector (p.g. 10).

Meanwhile, the demand for petrol-powered performance vehicles has resurged, with internal combustion (ICE) now accounting for 85% of all luxury vehicles financed, with electric vehicle (EV) uptake slowing considerably (p.g. 11).

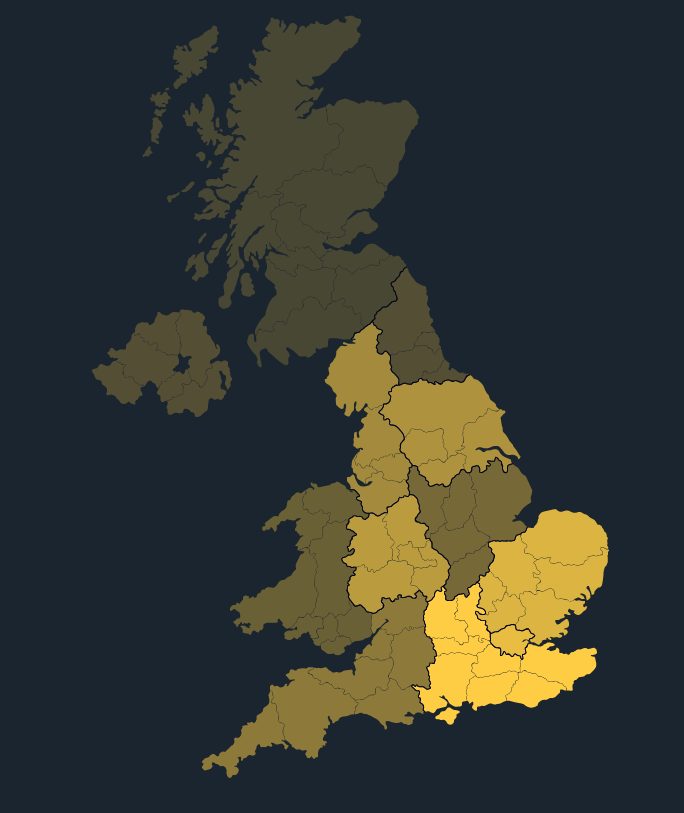

Most buyers are aged 35 to 49, and regional analysis shows growing demand outside London, particularly across the North West and Yorkshire.

Whether you are a dealer, lender, manufacturer, industry analyst, client or an enthusiast, the Luxury Car Report 2025 provides a comprehensive view of an industry in motion. It offers data-based insight and clarity to help understand trends and buyer behaviour to adapt strategies for the next phase of the luxury automotive market evolution.

Luxury car report overview

Avg. Luxury Car Sold Price

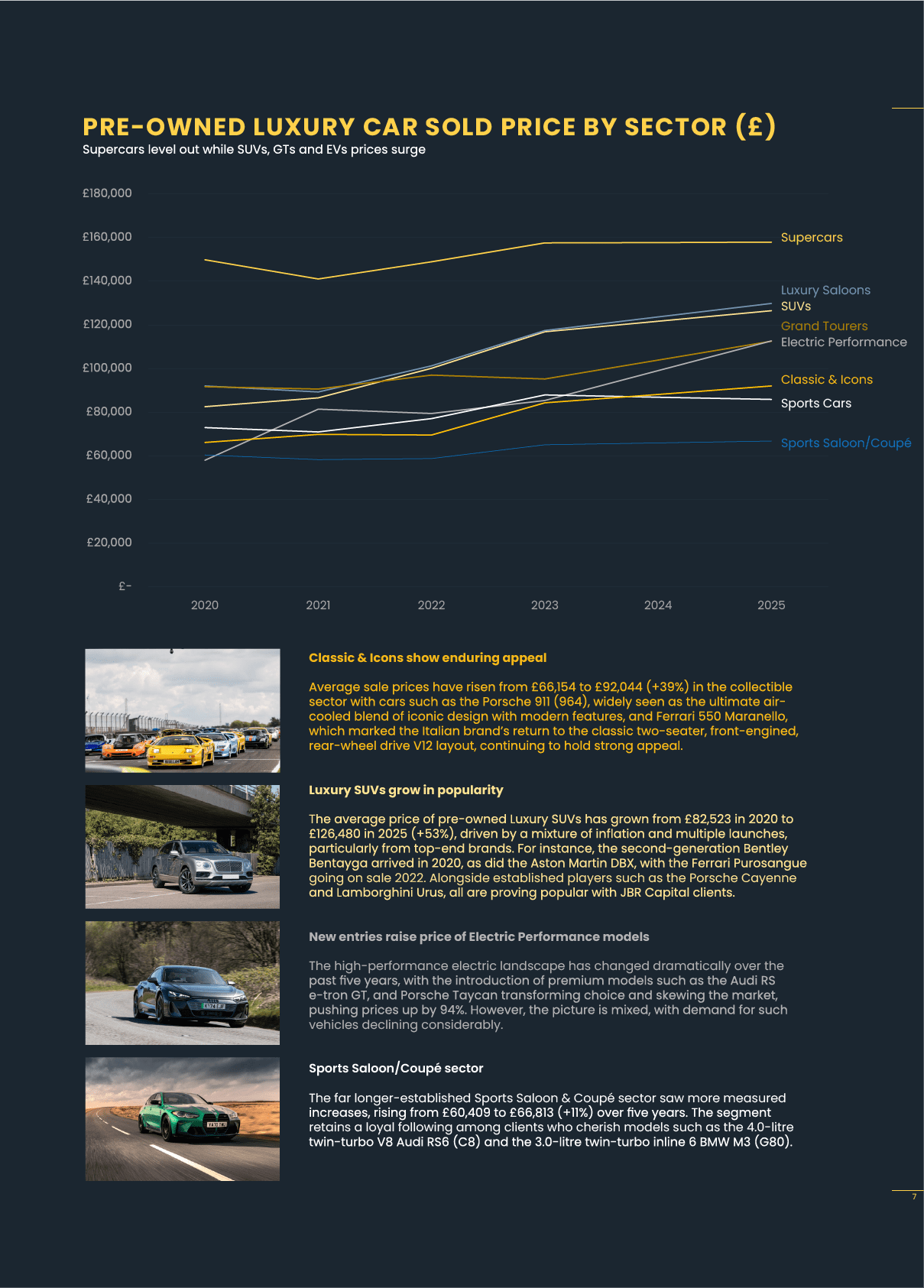

Luxury Car by Sector

Avg. Age of supercar owner

Avg. Loan to Value ratio

Avg. LENGTH OF TIME TO UPGRADE

UK Distribution

Most financed marque

Luxury brand market share

Luxury Car by fuel type