Supercar Hire Purchase

What is a hire purchase agreement?

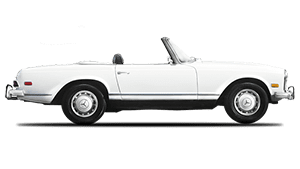

Owning your own supercar, classic car or prestige car has never been more affordable, thanks to our hire purchase options.

Choosing a hire purchase agreement allows you to pay for your car in monthly instalments and then you have the option to buy the vehicle at the end of the fixed term contract. Normally the APR (Annual Percentage Rate) is set before the contract begins, and loan periods are typically three to five years.

Once you have found the vehicle you would like to buy, let us know how much you want to borrow, based on the price of the vehicle minus any deposit. Many of our customers choose to part-exchange their existing vehicle to help cover the deposit.

Flexible

Bespoke Finance

We are a direct lender and we assess every finance application individually. We will assess your eligibility and make sure we offer a loan that suits your financial circumstances.

Great

Customer Service

We’ve built great relationships with classic car dealers and auction houses and have a wealth of industry knowledge which enables us to offer the best advice at every stage of the buying process.

Fast

Decision Making

We’ve paid out deals in less than 24 hours and £1m+ deals in less than a week, enabling our clients to act fast when they require cash.

Hire Purchase Process

How hire purchase works?

Once you have found the vehicle you would like to buy, let us know how much you want to borrow, based on the price of the vehicle minus any deposit. Many of our customers choose to part-exchange their existing vehicle to help cover the deposit.

If you are ready to start the journey towards owning the car of your dreams call us today on 020 3355 0035 and ask us for a quotation.

For more details check our extended ‘Guide to Car Hire Purchase’ >> >

1. Submit Application

3. Pay Deposit

2. Credit Approval

4. Drive Your Dream

1. Get In Touch

2. Submit Application

3. Pay Deposit

4. Drive Your Dream

Luxury, Classic & Supercars we finance

Click to view more marques

Hire Purchase Calculator

CONTACT US TO RECEIVE A BESPOKE QUOTE

Advantages of Hire Purchase

Your finance agreement is secured against the vehicle.

You are the vehicle’s registered keeper, which means you are responsible for the insurance and maintenance of the car.

JBR Capital remains the legal owner until the amount borrowed has been fully repaid, including the ‘option to purchase fee covering the admin costs when ownership is transferred.

Not sure if this is

the right choice?

If you’re interested in finding out more about how hire purchase can put you on the path towards owning the car of your dreams, it’s well worth calling us on 020 3355 0035 and speak to one of our advisors.

At the end

of the agreement

At the end of your HP agreement, you have the option to either buy the vehicle or part-exchange it to get a newer model or a different vehicle. Once you settle your hire purchase contract you will become the outright owner of the car.

Get a Quote

Talk to our team

What our customers say about us

View all of our reviews

Hire Purchase FAQs

Frequently Asked Questions

What is Hire Purchase?

Who owns the car?

Can I reduce my monthly payment?

How much deposit will I need?

What to do if I can't afford payment?

Can I arrange finance for more than one car?

What interest rate will I be charged?

I have bad credit; can I still get car finance?

Can I sell the car?

Can I settle the agreement early?

Hire Purchase news & Guides

Market Analysis, Opinions Pieces, Customer Stories and more

JBR Capital Luxury Car Report

Insights and Trends in the Luxury Car Market

Leaders are built, not born

Training future leaders is essential for any company that wishes to thrive, and that policy forms the bedrock of the constant learning culture of high-end automotive finance provider JBR Capital, as company CEO Nayan V. Kisnadwala explains.

Think before you click

Explore the pros and cons and caution before hitting the ‘place deposit’ button.

Trickle Down EV-nomics

The continued strength of UK EV sales not only points to a more robust market than some might fear, but also expedites the affordability of more sustainable mobility for all…

Alternatives to HP Finance

View all of our Finance Products below

Lease Purchase

Equity Release

Auction Finance

Credit Line