Finance your dream sports car

Sports car Financing

Sports car driving is ridiculously fun. The blend of high performance, beauty and sheer exclusivity gets your veins pumping like not much else.

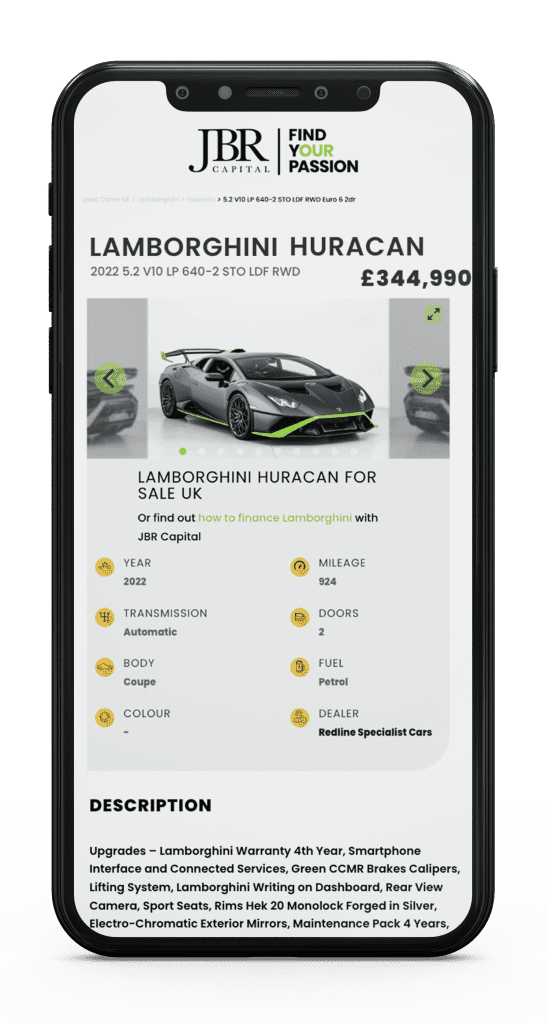

Did you know that with our bespoke sports car finance options, owning that sports car could be far more affordable than you think. There’s nothing to beat the sheer thrill of getting behind the wheel of a Ferrari, McLaren or any other sports car you desire. If you’ve chosen the perfect sports car for you, chat to JBR 020 3355 0035. We can talk you through your options and create a bespoke finance package.

Why use Sports Car Finance with us?

Classic and Sports car finance

Flexible

Bespoke Finance

Every sports car is unique, we offer highly personalised, custom-built finance solutions to suit you, your financial needs and your supercar. Interested in leasing a sports car? Try our sports car lease deals with one of our sport car lease packages.

Fast

Decision Making

Thanks to our expertise in sports car finance our team will deliver the ideal sports car finance package for you, quickly and effectively. Most of our customers get the go-ahead on their sports car finance within a week.

Types of Sports car Finance

We are a responsible lender and provide the most suitable finance option depending on a client’s situation and needs, with strong but realistic balloons & competitive Sports car financing rates.

Sports cars we finance

View all the sports cars we finance below

Sports Car Finance Process

How to Buy a on finance

1. Submit Application

3. Pay Deposit

2. Credit Approval

4. Drive Your Dream

1. Get In Touch

2. Submit Application

3. Pay Deposit

4. Drive Your Dream

Sports Car Finance Calculator

CONTACT US TO RECEIVE A BESPOKE QUOTE

What do we do

We are happy to lend anything from £50,000 to £750k, and to date, we have loaned almost £1 billion. We pride ourselves on personal service, which means that we don’t just punch numbers into a computer and wait for an answer – we talk to you, use our expert knowledge to assess you and your vehicle, and arrange a finance package to suit your needs.

As a result, we have received numerous awards and nominations, including the Auto Finance Awards, Motor Finance Awards and Car Finance Awards.

Our management team has decades of combined experience in the worlds of automotive finance and financial services. We are full members of the Finance & Leasing Association and abide by its FLA Lending Code on trading fairly and responsibly. We are also authorised and regulated by the Financial Conduct Authority.

Get a Quote

Talk to our team

Sports Car news & Guides

Market Analysis, Opinions Pieces, Customer Stories and more

Porsche 911 CARRERA vs GTS vs GT3 Review 2023 | Performance & Pricing

Three manual, rear-drive, two-seat Porsche 911s, but just one winner. Andrew Frankel pitches the new Carrera T against the GTS and GT3

JBR Capital Luxury Car Report

Insights and Trends in the Luxury Car Market

Lap of the Gods – Supercar Driver Secret Meet 2023

THE ANNUAL SECRET MEET AT DONNINGTON PARK IS SCD’S JEWEL IN THE CROWN, AND THIS YEAR’S EVENT MARKED A VERY SPECIAL ANNIVERSARY.

Leaders are built, not born

Training future leaders is essential for any company that wishes to thrive, and that policy forms the bedrock of the constant learning culture of high-end automotive finance provider JBR Capital, as company CEO Nayan V. Kisnadwala explains.

Sports car dealers with finance

You can buy your car from any recognized dealership, an independent dealer or a private seller.

You can also get a credit line ahead of a car auction, so you can have peace of mind when you bid for your desired vehicle.

We work with the best car dealers from the UK including DD Classics, Targa Florio, Dap Cars, Amari Supercars, Redline Specialist Cars and many more. View and apply for sports cars on finance at Find Your Passion.