Finance a Supercar

Supercar Financing

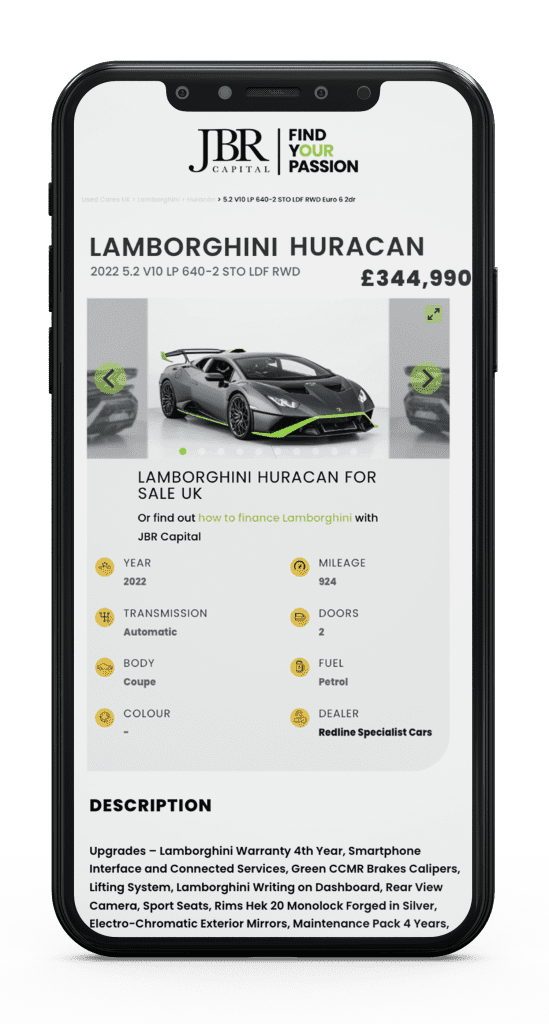

With our bespoke supercar finance options, supercar ownership could be far more affordable than you might think. Since every high-performance car is unique, so are our custom-built finance solutions, including flexible HP and lease purchase agreements.

Why Supercar Finance with JBR Capital

Can I finance a supercar?

Flexible

Bespoke Finance

We offer flexible and competitive finance from £50k to £10m+. Each finance deal is designed to suit your financial needs, putting you in control.

Great

Customer Service

We are petrol-heads ourselves and work with the best car dealership in the UK, which enables us to know the market inside out and have the expertise to put together realistic financing offers.

Fast

Decision Making

Most of our customers get the go-ahead on their supercar finance package within a week, so we can make your dream of owning a high-performance car a reality sooner than you might think.

Types of Supercar Finance

We take pride in the bespoke nature of our service, and our four core finance products can be tailored to meet your specific requirements.

Hypercars & Supercars we finance

Click to learn more about supercar finance

Supercar Finance Process

How to Buy a on finance

1. Submit Application

3. Pay Deposit

2. Credit Approval

4. Drive Your Dream

1. Get In Touch

2. Submit Application

3. Pay Deposit

4. Drive Your Dream

The Ultimate Driving Experience

For those looking for the ultimate driving experience, enter the world of the hypercar. If you’re looking to add a McLaren P1 or LaFerrari to your collection, we can put together flexible finance options to suit your financial circumstances, car, and future needs. Our hypercar finance packages have competitive interest rates, affordable monthly repayments, realistic balloons and early settlement options.

Once you’ve chosen the high-performance vehicle you want to purchase, you can either read our handy supercar finance guide and see what types of finance suit your circumstances, or give us a call directly for a no-obligation finance quote.

Discover more about what you should know before purchasing a supercar on our Supercar Buyers guide.

Get a Quote

Talk to our team

Supercar news & Guides

Market Analysis, Opinions Pieces, Customer Stories and more

On Board the First Hybrid Porsche 911

Discover the groundbreaking performance of the first hybrid Porsche 911. Explore the second-generation 992 Carrera GTS with insights from veteran racer Joerg Bergmeister.

Porsche 911 CARRERA vs GTS vs GT3 Review 2023 | Performance & Pricing

Three manual, rear-drive, two-seat Porsche 911s, but just one winner. Andrew Frankel pitches the new Carrera T against the GTS and GT3

JBR Capital Luxury Car Report

Insights and Trends in the Luxury Car Market

Supercar dealers with finance

You can buy your car from any recognised dealership, an independent dealer or a private seller.

You can also get a credit line ahead of a car auction, so you can have peace of mind when you bid for your desired vehicle.

We work with the best car dealers from the UK including DD Classics, Targa Florio, Dap Cars, Amari Supercars, Redline Specialist Cars and many more.

View and apply for a supercar on finance at Find Your Passion.

What our customers say about us

View all of our reviews

Supercar Finance FAQs

Frequently Asked Questions

What is considered a Supercar?

What is considered a Hypercar?

Can I refinance my existing Supercar?

We can refinance existing agreements with other lenders if you own a supercar valued at over £75,000. This could enable you to benefit from more competitive monthly payments and take advantage of any increase in the car’s value. Find out more about how to refinance your current vehicle.

How to buy a Supercar?

Supercar finance options

Can I get a credit line approved ahead of an auction?

Can I arrange finance for more than one Supercar?

Yes – we have financed multiple car purchases for many clients. We look to build long-standing relationships with our clients and we’ll be happy to assess your requirements.