Why finance a Jaguar with JBR Capital

Your dream Jaguar

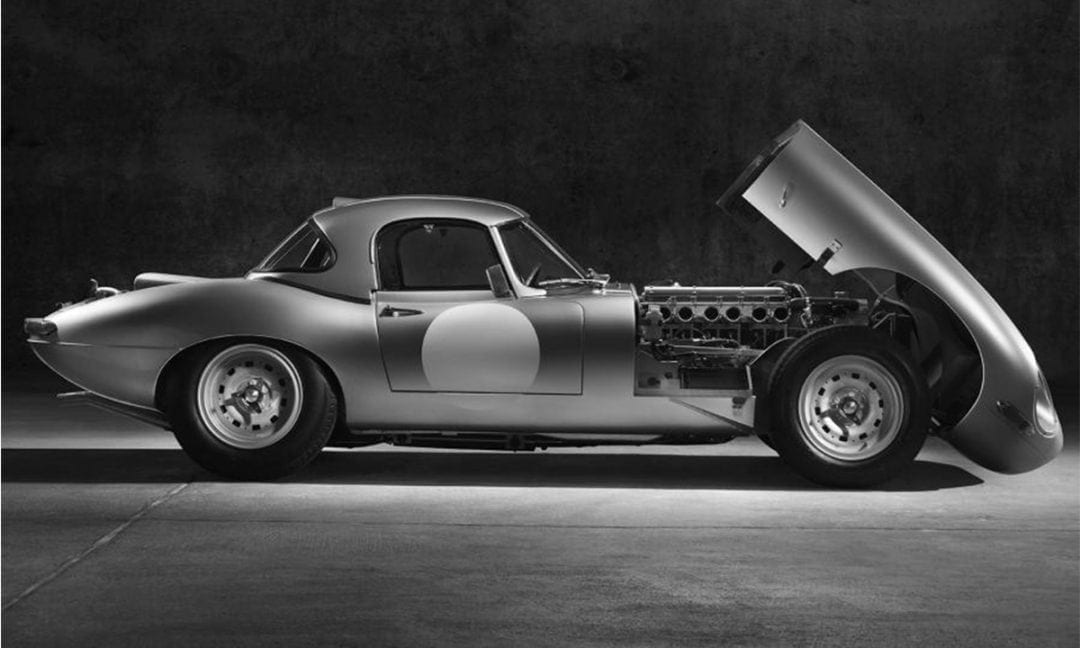

The big cat mascot of Jaguar has adorned the bonnets of some of the most desirable and drivable cars of all time, and in every era the marque has produced utterly iconic models. Skip forward to todays supercars and premium ranges and we find this same mix of iconic power with beauty.

Flexible

Bespoke Finance

Hunting for your dream Jaguar? Our holistic approach to underwriting, enables us to offer bespoke financing options to suit our high-net-worth clientele’s need.

Great

Customer Service

We have a wealth of experience dealing with both classic and modern Jaguars, so rest assured, we can give you the best finance offers on all Jaguar models.

Fast

Decision Making

Our human lead approach to underwriting and the fact that we are an lender, facilitates quick decision making when it comes to approving your Jaguar car loan.

Types of Jaguar Finance

Our personalised approach means that we may, depending on your circumstances, be able to offer finance to clients who do not fit the traditional computer-driven models of other companies.

Jaguar Finance Process

How to finance a new or used Jaguar

1. Submit Application

3. Pay Deposit

2. Credit Approval

4. Drive Your Dream

1. Get In Touch

2. Submit Application

3. Pay Deposit

4. Drive Your Dream

Jaguar Finance Examples

Jaguar Finance Deals & Offers from our partnered dealers

What our customers say about us

View our reviews

Jaguar Finance FAQs

How much deposit will I need?

Can I reduce my monthly payment?

You can reduce your monthly repayments by putting down a larger deposit at the start of a finance agreement, or deferring a lump sum (also known as a balloon payment) until the end of the agreement, which can be a useful option in some circumstances. Call us to discuss your options and we can explain more.

Can I arrange finance for more than one car?

Yes – we have financed multiple car purchases for many clients. We look to build long-standing relationships with our clients and we’ll be happy to assess your requirements.

I have bad credit; can I still get Jaguar on finance?

What interest rate will I be charged?

Can I settle the agreement early?

Can I sell the car?

Once you’ve paid off the outstanding sum it’s yours and you can do whatever you like with it. However, while you’re still paying off the finance you aren’t legally entitled to sell the car.

Jaguar news & Guides

Market Analysis, Opinions Pieces, Customer Stories and more

Rm Sotheby’s The Youngtimer Collection

See stats, best cars sold and auction review for RM Sotheby’s Youngtimer Collection. This highly anticipated event saw 140 modern classic cars go under the hammer, across 4 events between February and April 2019.

LOW STRESS CLASSICS – c. £100k – £1m

In Part 1 we considered our pick of the more affordable Low Stress Classics and here in Part 2 we look at some higher-end classics.

1960s Classic Trinity

Prompted by the first episode of Clarkson, May and Hammond’s Grand Tour, last November we wrote a feature on the Ferrari LaFerrari, McLaren P1 and Porsche 918 Spyder, aka The Holy Trinity. And that got us thinking about similar Holy Trinities of yesteryear.

Classic Car Barn Finds

Ever dreamed of discovering a lost classic car? We spoke to eight car experts who did just that. They share their stories of memorable classic car finds.

New & Used Jaguar for sale on Finance

View Jaguar listings from our partnered dealers

Other classic car and supercar brands we finance

Select the right marque for you